More and more organizations are moving towards using data analytics to inform their product offerings and services. However, one sector in particular is lagging and for no apparent reason. The financial sector. Let’s take retail finance as an example.

If you think about all of the information banks have about their customers (given that transactional banking has taken such a digital turn), you would expect them to have moved into data analytics a long time ago. Yet many of us still find ourselves puzzled by where to invest our money, how to achieve our financial goals, and how to ultimately accumulate more money. If banks know everything about my finances (which I assume they do since I barely ever pay with cash nowadays…) why can’t they just use my payments and asset data in order to give me smart recommendations on how to achieve my financial goals?

Many aggregator websites such as MoneySuperMarket, Confused.com, or CompareTheMarket provide a great information architecture for people to understand their banking and investment options. What if they take it a step further, and plug in a large data base of your own transaction and asset history, in order to give personalized advice you didn’t even know you needed? Well aggregator websites aren’t doing it as they don’t have that data… Banks do! So for the bankers out there… Get on it! That is how you can beat the aggregator websites who steer your customers towards competitors.

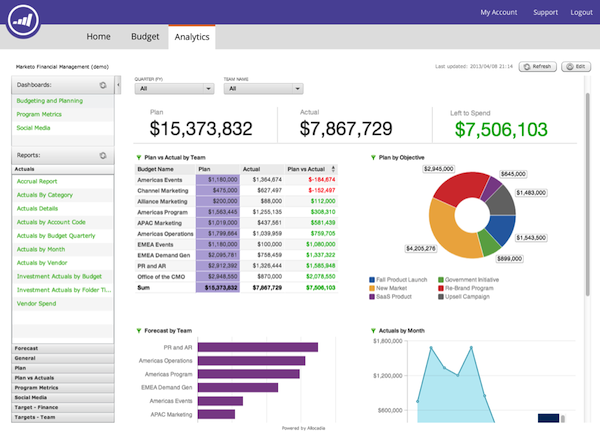

So how exactly can banks leverage the power of data in order to help people and/or business to save time and money? The data that banks harvest is extensive; ranging from individual purchases and spending habits to business inventories, transactions and trends. Technology has already revolutionized retail transactional banking. It’s time to embrace the power of data analytics.

In light of my very strong sentiments towards the lack of analytics in banking, I designed and submitted a concept to a bank outlining a revolutionary way to change private retail banking experience. Well… I say “revolutionary” as I’m obviously biased. But I have to say, if a bank offered this concept as an experience, I would switch to that bank immediately. Stay tuned for more… I will upload the concept shortly.